Pirate Capital, 'shareholder activist' hedge fund, is liquidating. Top holdings: BCO, CEC, PWEI, PBY, GY, GLT, JRCC, AGL, ADG, CBUK

Thursday, September 28, 2006

Pirate Capital, 'shareholder activist' hedge fund, is liquidating. Top holdings: BCO, CEC, PWEI, PBY, GY, GLT, JRCC, AGL, ADG, CBUK

Housing Market Slowdown

As the Dow hits a historic record high I wanted to examine all this talk about the housing market. The common theme (always be weary of common themes) is that this consumer led economy is based on equity from appreciating real estate prices. Resetting ARM's and higher interest rates would kill the consumer and hence the economy. So what happened?

Interesting research from Citigroup regarding this phenomenon. In 1995, home sales actually fell 15.6%, more so then the current rate of 13.2% in August. The first graph shows real consumer spending, real income, and a projected spending based on the level of mortgage equity withdrawals. This discrepencacy basically is saying that consumer spending SHOULD be much higher if mortgage equity was driving spending.

After a few days of cramming, I passed the Series 7 with an 87%. I am now armed & dangerous.

Friday, September 22, 2006

Bond prices have been rallying for almost two months, Bill Gross is calling this the beginning of the bull market in bonds. The 10 year is yielding 4.61% while the Fed Funds overnight is 5.25%. The Philly Fed number yesterday could have been the shot across the bow for this economy. So if you think the FED will cut rates in the future, you can get your hands on March '07 FED Funds futures for 94.87 bid 94.89 offer. This implies a yield of 5.11%, should the FED cut rates you could expect the price to go up to 95 or better and March delivery gives you 3 meetings.

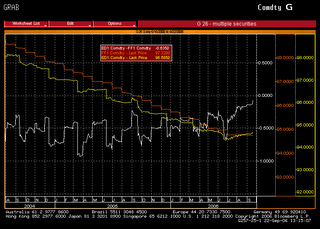

EDIT: You know I love charts, what would I do without my Bloomberg? This one's the FF futures and EuroDollar futures, along with the spread:

Thursday, September 21, 2006

We were doing a little research this morning to see if the nati gas or even crude oil market may have gotten a little out of whack due to Amaranth. From what we've heard, Brian Hunter was long March '07 Gas, and short April '07 Gas creating a time spread. The position was entered @ 2.14 and finally closed @ .75

Here's what the spread looked like in '05 just for comparison:

Wednesday, September 20, 2006

Now may be a good time to pick up some interest in Thailand, Southeast Asia's 2nd largest economy. The market has been held down due to political uncertainty and recent explosions in the tourist district. Now a Coup doesn't exactly sound like it brings stability to the area however this could be the culmination of recent turmoil and stability will follow. Rumor is that the new PM could be the central banker, which should be positive for the economy. Before this mess happened, the Central Bank was thinking of cutting rates and GDP was around the 5.5%. I'm looking at TTF or TF, whenever these things happen to open.

EDIT: Interesting chart.

Tuesday, September 19, 2006

Since it's in the news and had major impacts on our markets in the past (think Vic Niederhoffer), I found a good summary of the events that created a huge market drop in July of 1997:

"Imagine for a moment that you are a Thai banker. You borrow $1 million dollars (at, say, 10 percent interest) and convert this sum into 25 million Baht, which you expect to lend in Thailand for an interest rate of 15 percent.With the Thai government's exchange rate promise in force, this appears to be a good deal for everyone. The US lender gets 10 percent interest. The Thai borrower gets access to funds for business investment that might not be available if you didn't borrow abroad. And you stand to gain the difference between the 15 percent interest you will collect and the 10 percent interest you owe. If everything works out as planned, you stand to collect $50,000 on this deal (5% of $1 million) from the difference in interest rates. Very nice, don't you think.

However, the biggest impacts were in the financial sectors and to see this you need to think about yourself as a Thai banker again. Recall that great investment you made just a few paragraphs ago. You borrowed $1 million at 10 percent interest in the US, which you converted into 25 million Baht. You lent the Baht in Thailand at 15 percent interest. Your reward? The difference between the two interest rates, or about $50,000 per year. Not bad for a few hours' work, eh?But this profit was based on your assumption that the government would honor its pledge to keep the exchange rate fixed at 25 Baht per dollars. Here's where you stand after the currency crisis.You borrowed $1 million and you lent 25 million Baht. If your loan is repaid on time and with all the 15 percent interest you are due, you should get back about 28,750,000 Baht. At the post-crisis exchange rate of 50 Baht per dollar, this sum is worth only $575,000 -- much less than the $1 million you borrowed.You are bankrupt.

You owe $1 million and you have no prospects to repay it. Although you have made good business decisions -- perhaps you have lent the money efficiently and will get repaid in full and on time (in Baht) -- you cannot possible repay your US dollar loan because to do so requires twice as much Baht as you expected.

You are bankrupt (deep in debt beyond your means to repay), but because you are a banker this problem affects many more people than you. Your depositors will become concerned about their funds and may stage a run on the bank. You will be less able to give new loans to Thai borrowers. You may have to call in existing loans, forcing current borrowers to liquidate their investments, perhaps even forcing them into bankruptcy."

~source International Political Economy

Monday, September 18, 2006

Another chart for you spread lovers out there. This one's the IYR (realtor real estate) ETF, things like REIT's basically versus two homebuilders. Now the thinking is a housing blow-up will cause rental markets to skyrocket so this is a little contrarian, however the REIT's are the one sector that hasn't really seen much of a correction and some of these names are getting overvalued. Should some other sectors rebound, watch money flow out of there like whats going on in some of the consumer staples:

My favorite section of craigslist. LOL. In the news is the hedge fund Amaranth based in my old hometown of Stamford, CT. It's a multi-strategy fund that is down 35% due to losses in natural gas. I phone interviewed with those guys earlier in the year, needless to say I didn't get the job. Maybe I could've prevented this disaster.....wishfull thinking ;) Some of the traders around here were hungirly looking at their holdings, with the idea that they may have to liquidate. Markets are what's known as Marked to Market, Amaranth would've received margin calls much earlier and liquidating way before they released this information. Not a bad idea but I don't think there's much there.

Friday, September 15, 2006

I wrote this quick thesis a little while back but found the spread at the end of the post interesting enough to post:

· Recent accounting scandals have been resolved which had kept a lid on the stock prices.

· Adjustable Rate Mortgages, popular in recent years for speculation, will begin to reset in 2006 and 2007 from as low as 2% to 7% for potential increase in earnings.

· November elections highly favor a democratic congress, which should be favorable for mortgage availability. Current administration would like to limit the amount and types of loans FNM/FRE can make.

· UBS recently predicted an interest rate cute in March ’07. Historic analysis on these stocks showed a run-up in price in anticipation of a Fed rate cute and a sell-off upon the news.

· Technical reading of stock charts and volume shows the stock is currently under accumulation. Also recent stock action has shown bullish characteristics.

· As the largest mortgage dealer in the US, FNM should have the expertise to be well positioned for the obvious and much anticipated housing ‘crash’, therefore any positive scenario would be twice as beneficial.

EDIT: 2 HUGE prints in GOOG in the last 30 mins of trading. 1.13 million shrs and another 500,000 shrs printed. Thats over $600 million notional at play. Somebody is making a bet and their serious about it!

Google was in a tight range the past month or so and recently broke out to the upside. This was borrowed from Barron's which was borrowed from hitwise.com:

Looks like Google has been increasing market share, probably since I linked AdSense to this blog. LOL

The volume yesterday in September QQQQ options was immense:

QQQQ Sept. 40's calls traded 144,423 contracts

QQQQ Sept. 40 puts traded 111,070 contracts

This is especially interesting because these options expire TODAY. Looks like a straddle on the Q's. Should be some big movers.

Thursday, September 14, 2006

Wednesday, September 13, 2006

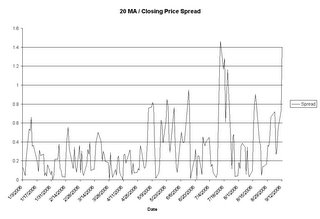

Something I like to look at is the spread between the closing price & the 20 day MA:

As of yesterdays close, the spread was 1.4. The previous spike in July was 1.46. You can see from the other graph that this was a good buy point. I especially like this with ETF's because they tend to be less volatile and more arbs keeping the price in check. However it came to my attention that this a pretty strong sector and selling it short is a really contrarian play.

I had an interesting thought from http://www.minyanville.com regarding the relationship between the US dollar and Commodities. Check out this graph below and you can make out an inverse relationship between the US dollar and the CRB, which recently broke its long time 200 day MA. This move implies strength in the dollar (which I can attest to the recent strength in USDJPY).

The market rally yesterday caused the VIX to fall to 11.92. Take a look at a long term VIX chart and this is an extremely low level and in my opinion a great risk reward trade. Little downside risk and potentially huge upside gain. The major threat to this position is theta loss.

Warning! When you enter a long VIX position you have a tendency to root for worst case scenarios (VIX & SPX are inversely related) , the president of Iran can be your best friend in this situation. Be careful in public about voicing any hopes that Iran comes out with a nuclear weapon.

For those who don't know me I tend to be pretty sarcastic at times ;)

Tuesday, September 12, 2006

Fiber-Optic & High Speed Broadband

- The major trend in home entertainment has been video on demand and digital recording technologies. In the future household, viewers will be able to download full-length DVD quality movies and shows on demand and quickly and television shows will become interactive. In order for all this technology to become a reality, network infrastructure and Internet infrastructure needs to be upgraded. The industry leader in Internet infrastructure technology is Cisco Systems.

- The corporate standard across US companies is Cisco equipment. IT departments have few options when it comes to network purchases. Despite competitors like Juniper, Cisco has virtually a monopoly in this business.

- Cable companies and large Telecom’s are scrambling to provide end users with this technology and to beat each other to market. Most noticeable is Verizon, which is making a large bet on fiber to the home. Industry insiders see large demand and potential in the FiOS business. Although cable and telecom represent attractive potential investments, the competitiveness in the marketplace will create a winner and loser, whereas Cisco should see benefits no matter who wins the battle.

- Mobile video is another major trend; of note is the Apple release of an IPOD that will now be able to download movies and television shows in a portable device. This will further constrain existing bandwidth capacity and call for upgrades to the infrastructure.

- Cisco is also a large cap stock and positioned for any rotation from small cap to large cap stocks. Should the economy take a turn for the worse, large caps should be better positioned.

- The tape is showing some major institutional interest with an unbelievable 90 blocks of 100,000 shares trading in one day. Large numbers of blocks have continued to trade since that time. As of 6/30, Bill Miller of Legg Masson value fund had 1.24% of his net assets invested in Cisco.

- Cisco giveth and Cisco taketh., many investors became millionaires overnight and loss just as much in this high flying internet stock in the 90’s. Many investors probably assume a once bitten, twice shy attitude regarding this stock and further price appreciation could fuel these investors to get off the sidelines and become believers.

- The Japanese economy may or may not be slowing, however capital expenditure by corporations has been rising. A major portion of Japanese GDP comes from technology-based companies.

Short HLT @ 27.47, Target = 26, Stop = 28

Stopped out @ 28. Put some bids in for Oct. 25 puts. Still looking for a minor correction but oil selling off has been really helping the market.

Interesting action on the tape today, selling utilities. We watch sector rotations VERY carefully, this can lead to some huge trades. Shorting transports and buying staples & utilities was the play in July. The utility index broke its 50 day MA, will the safety stocks follow?? Even more important, where's the money flowing - tech, bonds, or cash?

Edit: Here's a chart of the XLU (utils ETF) vs. XLP (consumer staples ETF). Hedged trade here would be short the XLP's and long the XLU's, or use the options.

"You know why most fund manager's can't beat the S&P 500? Cause their sheep." ~Gordon Gekko

Fund managers tend to read the same research, listen to the same guys, and basically do the same thing. There's only 500 stocks to invest in and since their all compared to each other there's a lot of pressure to be in the winners. So these guys have a tendency to window dress their portfolio's at quarter end to say, "see, we were in XYZ, hottest stock on the Street." and drive the price up to inflate their returns.

Here's a breakdown of the best/worst performing sectors since June:

Consumer Staples (+8%)

PG (18%)

MO(15%)

Utilities (+7%)

TXU (13%)

DUK (5%)

DOM (-19%) interesting

Health Care (+4%)

JNJ (5%)

PFE (17%)

Industrials (-4%)

UPS (-12%)

MMM (-13%)

~from Tickersense.com

Monday, September 11, 2006

I'm going to take a shot short here, even though its a strong stock in strong sector:

Short KMB @ 64.97, Target = 63.50, Stop = 66.00

Stopped @ 66. There was a slight profit before the market turned. Oil.....

Buyout rumor on the squawk box driving JOE $4 to the upside. Hhuge short interest and no call volume makes me skeptical of this 'rumor'. In fact, there's more put volume. Maybe some big guys want to liquidate some positions - they called The Wall Street Chronicle and told the man, 'Bluehorseshoe loves St. Joe's."

This is basically a bet on Crude Oil but I'm on the lookout for a quick bounce based on the daily's and the models (more on this in a later post). Will report if I put on a position.

I am the owner of Oct. 60 Calls. Would have gotten a better price if I had any extra cash....

Wow, what a sh*tty call! Chalk that up as a learning experience. When commodities trend, get on the train or get outta the way! Here's something to ponder though, Crude Oil versus VLO:

Quick scalp: Short WMT @46.67, Target = 45.50, Stop = $47

Edit:

Stopped out @ 47. There was a slight positive before the Mayor of Chicago f*ed it all up by vetoing the minimum wage law towards WMT. Trying to post an intraday chart but not having much luck. I'd restablish a short position depending on how this closes.

Will get back in should WMT hit 47.75

Back in to WMT with Oct. 45 puts.

Edit: 2 large prints on the tape 7.9 million shares and another 3.51 million. Assuming $4.70/shr that's $53.6 million notional value. Big money!

That's right, a blast from past, this stock has probably burned investors out of millions and perhaps even billions due to accounting shennanigans. Check out this recent chart:

See all that buying? What caught my eye is all the block trading in this stock, I would estimate that 60-70% of the daily volume is in blocks. Even though this is a little 4 dollar number, the presence of so many blocks leads me to believe there's institutional interest in this name.

This currently trades OTC, but the company has plans to relist on the NYSE in October, I could imagine a nice quick scalp when it does. In addition, there will be a 1:5 reverse split to artificually boost the price. The company is in turn around mode and selling off the diagnostics business to focus on rehab centers and elderly care. They have hired Goldman Sachs to tackle the leveraged debt on their balance sheet.

Sunday, September 10, 2006

Here's a recent chart of Pep Boys:

Notice the heavy accumulation of the stock through mid-August. Two major hedge funds, Pirate Capital LLC & Barrington Capital Group have been accumulating large positions. 9.8% & 11.6% recently. Also announced a dividend announcement and $100 mln buyback. All of that doesn't really excite me too much but what is interesting is some recent Citigroup research. They valued the real estate alone worth at least $27/shr. Check out some recent Private Equity buyouts:

Notice the heavy accumulation of the stock through mid-August. Two major hedge funds, Pirate Capital LLC & Barrington Capital Group have been accumulating large positions. 9.8% & 11.6% recently. Also announced a dividend announcement and $100 mln buyback. All of that doesn't really excite me too much but what is interesting is some recent Citigroup research. They valued the real estate alone worth at least $27/shr. Check out some recent Private Equity buyouts: The trend in P.E. has been to buy these struggling retailers to get at the underlying real estate; and hey, if they can turn the business it could add even futher value.

The trend in P.E. has been to buy these struggling retailers to get at the underlying real estate; and hey, if they can turn the business it could add even futher value.

Saturday, September 09, 2006

Reminiscensces of a Stock Operator

The stock traders bible, everyone recommends it for a reason.

Options as a Strategic Investment

A MUST have, repeat MUST have if you want to trade options. It goes over all the basic strategies as well as some depth into options pricing (aka greeks). Read it a few times before you trade options or you'll get burned. You'll learn why a stock can move 5 pts in a day but a call option can actually LOSE value.

Mcmillan on Options

A further investigation of options trading and some very interesting strategies. Note however that many of the strategies described in the book may not be relevant today.

The New Market Wizards

Great insight into the minds of some of the most succesfull investors.

Liars Poker

Read this, you'll love it. Not specifically about trading but great story and background. I don't think that Wall Street is exactly like this anymore, a little more PC but still some pockets of the good 'ol days exist.

Wall Street

Some great insight into increasing the probabilities of your trades. ;)