Trade Idea

Bond prices have been rallying for almost two months, Bill Gross is calling this the beginning of the bull market in bonds. The 10 year is yielding 4.61% while the Fed Funds overnight is 5.25%. The Philly Fed number yesterday could have been the shot across the bow for this economy. So if you think the FED will cut rates in the future, you can get your hands on March '07 FED Funds futures for 94.87 bid 94.89 offer. This implies a yield of 5.11%, should the FED cut rates you could expect the price to go up to 95 or better and March delivery gives you 3 meetings.

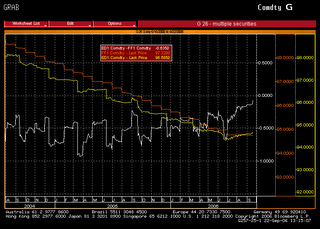

EDIT: You know I love charts, what would I do without my Bloomberg? This one's the FF futures and EuroDollar futures, along with the spread:

Bond prices have been rallying for almost two months, Bill Gross is calling this the beginning of the bull market in bonds. The 10 year is yielding 4.61% while the Fed Funds overnight is 5.25%. The Philly Fed number yesterday could have been the shot across the bow for this economy. So if you think the FED will cut rates in the future, you can get your hands on March '07 FED Funds futures for 94.87 bid 94.89 offer. This implies a yield of 5.11%, should the FED cut rates you could expect the price to go up to 95 or better and March delivery gives you 3 meetings.

EDIT: You know I love charts, what would I do without my Bloomberg? This one's the FF futures and EuroDollar futures, along with the spread:

0 Comments:

Post a Comment

<< Home