XLY TRADE

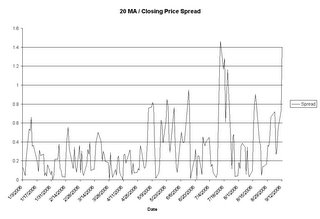

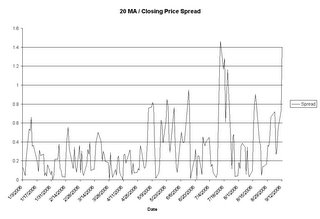

Something I like to look at is the spread between the closing price & the 20 day MA:

As of yesterdays close, the spread was 1.4. The previous spike in July was 1.46. You can see from the other graph that this was a good buy point. I especially like this with ETF's because they tend to be less volatile and more arbs keeping the price in check. However it came to my attention that this a pretty strong sector and selling it short is a really contrarian play.

Something I like to look at is the spread between the closing price & the 20 day MA:

As of yesterdays close, the spread was 1.4. The previous spike in July was 1.46. You can see from the other graph that this was a good buy point. I especially like this with ETF's because they tend to be less volatile and more arbs keeping the price in check. However it came to my attention that this a pretty strong sector and selling it short is a really contrarian play.

1 Comments:

Can you elaborate a bit more on why you like to use this particular strategy? What is it telling you. What are thre caveats to using this strategy? What markets does this idea work best in?

Post a Comment

<< Home