Options Lesson

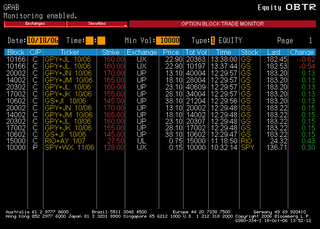

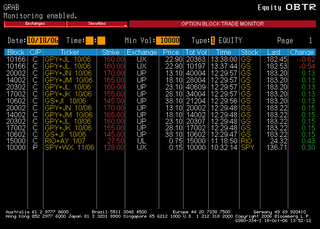

Random lesson from the options market. See these block trades:

My first reaction was go long Goldman Sachs, ton of blocks for ITM calls expiring in 2 days!!!! Then I remembered it was options expiry week. Here is how the scenario plays out, customer calls MM and buys GS Calls, MM sells calls to customer (short calls) and buys stock to hedge position. Since it is near expiry, customer then closes option positions by selling calls back to MM, MM now flat option position and sells hedged stock. Partially the reason GS is down .95 right now.

Keep in mind we've had quite a run and this same process could be happening in a few stocks. Remember the turnaround noon yesterday. This selling could only be temporary. Or maybe someone actually thinks a crazy guy in N. Korea with nuclear weapons might be bad for our market.....

Random lesson from the options market. See these block trades:

My first reaction was go long Goldman Sachs, ton of blocks for ITM calls expiring in 2 days!!!! Then I remembered it was options expiry week. Here is how the scenario plays out, customer calls MM and buys GS Calls, MM sells calls to customer (short calls) and buys stock to hedge position. Since it is near expiry, customer then closes option positions by selling calls back to MM, MM now flat option position and sells hedged stock. Partially the reason GS is down .95 right now.

Keep in mind we've had quite a run and this same process could be happening in a few stocks. Remember the turnaround noon yesterday. This selling could only be temporary. Or maybe someone actually thinks a crazy guy in N. Korea with nuclear weapons might be bad for our market.....

0 Comments:

Post a Comment

<< Home